In hindsight, all it took for real institutional adoption of Bitcoin to take place was the introduction of a risk-minimized, easy-to-use product in the form of an exchange-traded fund (ETF). In January, the SEC approved nine new ETFs that provide exposure to Bitcoin through the spot market, a strict improvement over the futures-based ETFs that began trading back in 2021. In the first quarter of trading, both the size and number of institutional allocations to these ETFs have blown away consensus expectations. Blackrock’s ETF alone set a record for the shortest time an ETF has hit $10 billion in assets.

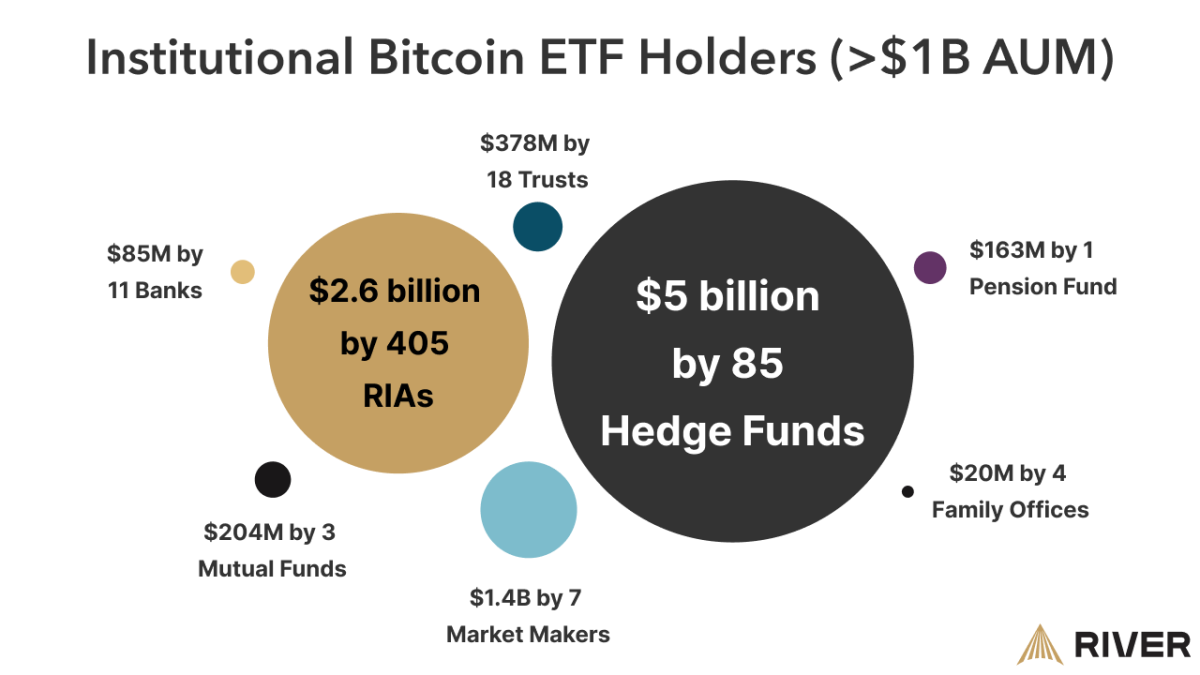

Beyond the eye-popping AUM figures these ETFs have drawn, this past Wednesday marked the deadline for institutions with over $100 million in assets to report their holdings to the SEC through 13F filings. These filings reveal a complete picture of who owns Bitcoin ETFs—the results are nothing short of bullish.

Institutional Adoption is Broad-Based

In years past, a single institutional investor reporting ownership of bitcoin would be a newsworthy, even market moving event. Just three years ago, Tesla’s decision to add bitcoin to their balance sheet sent bitcoin up over 13% in a single day.

2024 is clearly different. As of Wednesday, we now know of 534 unique institutions with over $1 billion in assets that chose to begin allocating to bitcoin in Q1 of this year. Ranging from hedge funds to pensions and insurance companies, the breadth of adoption is remarkable.

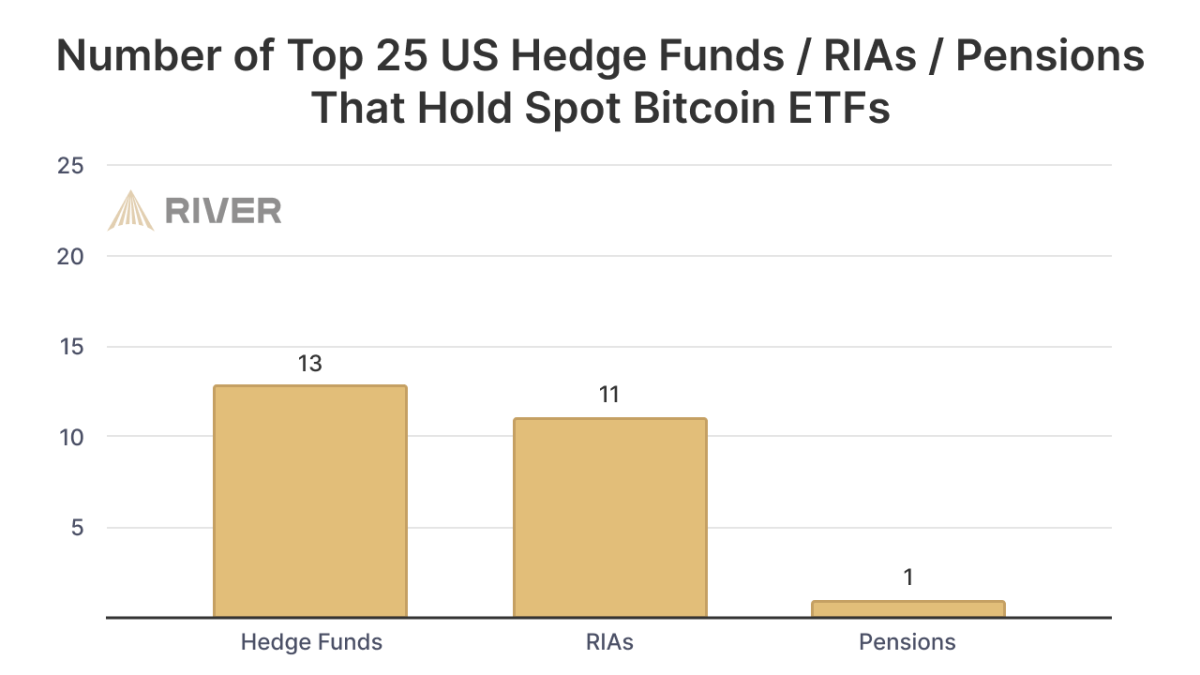

Of the largest 25 hedge funds in the US, over half now have exposure to bitcoin, most notably a $2 billion position from Millennium Management. Additionally, 11 of the largest 25 Registered Investment Advisors (RIAs) are now allocated.

But why are Bitcoin ETFs so appealing to institutions who could’ve just bought bitcoin?

Large institutional investors are slow moving creatures from a financial system steeped in tradition, risk management, and regulations. For a pension fund to update its investment portfolio requires months, sometimes years of committee meetings, due diligence, and board approvals that are often repeated multiple times.

To gain exposure to bitcoin by purchasing and holding real bitcoin requires a comprehensive vetting of multiple trading providers (e.g. Galaxy Digital), custodians (e.g. Coinbase), and forensics services (e.g. Chainalysis), in addition to forming new processes for accounting, risk management, etc.

To gain exposure to bitcoin by purchasing an ETF from Blackrock is easy by comparison. As Lyn Alden put it on a TFTC podcast, “All the ETF is, is in developer terms, it’s basically an API for the fiat system. It just allows the fiat system to plug into Bitcoin a little bit better than it used to.”

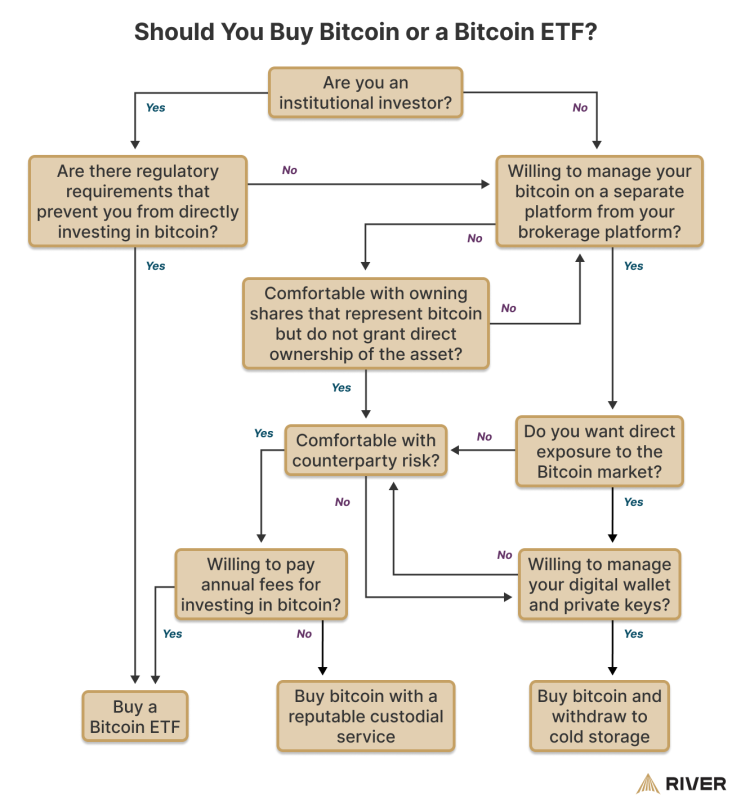

This is not to say that ETFs are the ideal way for people to gain exposure to bitcoin. In addition to the management fees that come with owning an ETF, there are many tradeoffs that come with such a product that may compromise the core value provided by Bitcoin in the first place—incorruptible money. While these tradeoffs are beyond the scope of this article, the flowchart below depicts some of the considerations at play.

Why hasn’t Bitcoin rallied more this quarter?

With such a strong rate of ETF adoption, it may come as a surprise that the price of bitcoin is only up 50% year-to-date. Indeed, if 48% of the top hedge funds are now allocated, how much upside could really be left?

While the ETFs have broad-based ownership, the average allocations of the institutions that own them are quite modest. Of the major ($1b+) hedge funds, RIA’s, and pensions that have made an allocation, the weighted average allocation is less than 0.20% of AUM. Even Millennium’s $2 billion allocation represented less than 1% of their reported 13F holdings.

The first quarter of 2024, therefore, will be remembered as the time when institutions ‘got off of zero’. As for when they will get past dipping their toes in the water? Only time will tell.

This is a guest post by Sam Baker from River. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.