Macro – Crossing the Rubicon

1. Donald J. Trump and the point of no return. 3 words, “Strategic Bitcoin Stockpile”. It was theorized by many Bitcoiners for years, some would even say dreamed of, and it happened just last week. Fair to say that Bitcoin has indeed crossed some sort of Rubicon on Saturday, a point of no return where everything can suddenly accelerate. The culprit? – goes by the name of game theory. Nations around the world, from this day forward, have to take this idea of a Bitcoin reserve seriously or face the consequences of being left behind. If enacted, the US will own around 1% of the total bitcoin supply.

From the perspective of other countries, this strategy would be tough to replicate as the US basically got this bitcoin for free (through what could most likely be considered illegal and immoral means). Competing nations would be faced with the daunting/impossible task of accumulating hundreds of thousands of bitcoins without paying a huge premium for it. This is where Bitcoin mining becomes a matter of national security. On the back of that announcement from Trump, Michael Saylor also laid out a framework for nation-state adoption of bitcoin as a treasury asset (How to do it sensibly and why it makes sense) in front of 10+ senators. A good idea whose time has come is unstoppable.

2. Institutions are here. The same game theoretics apply for institutions. If nation-states are accumulating Bitcoin, corporations must do the same. Nation-state accumulation basically guarantees price go up over the long term, which means dollar-denominated corporate treasuries will suffer in relative terms. It becomes a bright line denominating winners and losers. Moving part of the treasury into BTC won’t even necessarily make you a winner, it’ll be the baseline requirement to compete. Anyone who doesn’t do it will just be left behind. “It might make sense just to get some in case it catches on”

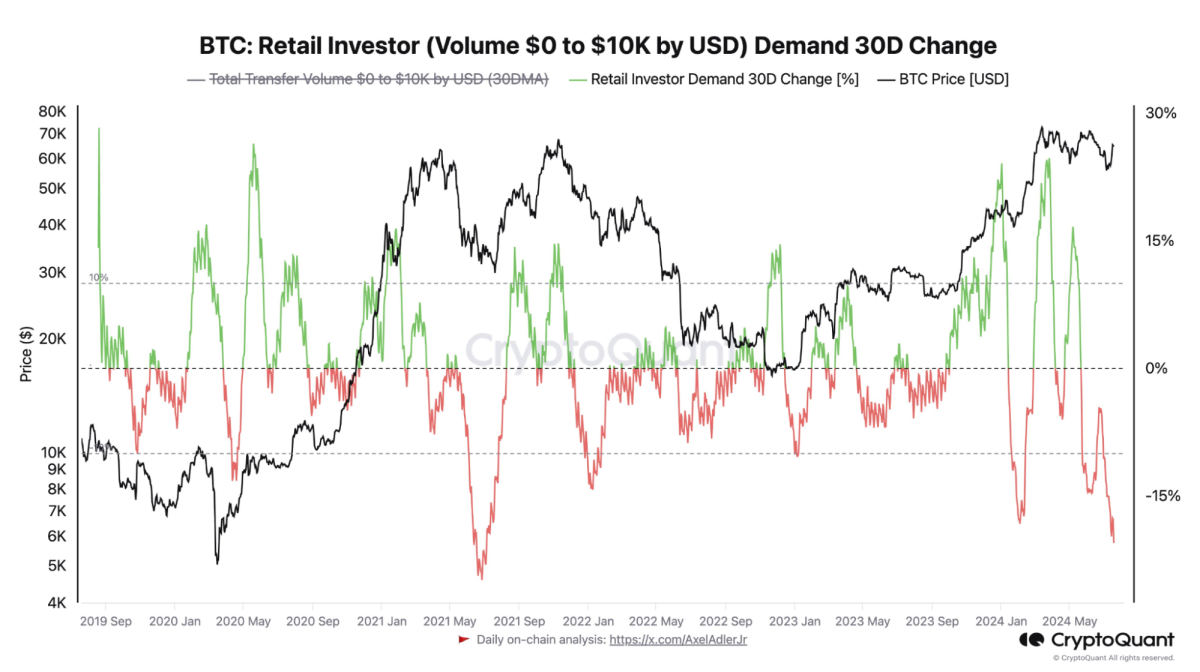

3. Retail is still absent. As the chart below describes, retail flow measured by the 30-day change in total transfer volume for transactions under $10K, is at a 3-year low. Despite BTC being less than 10% away from ATH.

While the conference was an inevitable success in terms of retail participation, it would appear that retail buyers are either exhausted, already all-in or not willing to buy additional BTC at those prices. Another possible explanation for this was the overall feeling throughout the conference of “waiting for the next catalyst”.

UTXO Alpha Day – The first of many for Venture Capitalists

1. We are blessed to support the best people. UTXO Management was hosting its inaugural investor day, UTXO Alpha Day, at the Bitcoin 2024 conference. We assembled hundreds of capital allocators, entrepreneurs, institutional investors, and angels for the event, where we explored yield-bearing assets in Bitcoin, the landscape of new Bitcoin layers, and the emergence of Bitcoin as the ultimate treasury asset. The event was a success and a great reminder that Venture Capital is first and foremost about exceptional individuals all competing to bring new utility to Bitcoin. BTC Startup Lab also hosted an incredible mixer event on Friday where we had the pleasure of meeting many different investors and founders. I left the event with the feeling that Bitcoin founders are a rare breed that must be welcomed by the US with open arms. Their focus is very much on building and gearing up for a Bull market – expect everything to happen all at once when Bitcoin decisively breaks its previous ATH.

One of the main takeaways from the conference was that investor appetite for Yield strategies native to Bitcoin is growing beyond what we initially anticipated. When we talk about idle capital, most people tend to think about the millions of BTC sitting in wallets, however, last week it became clear that the opportunity is equally attractive to crypto investors currently allocated on different blockchains. TVL is mercenary in the current environment and many discussions we’ve had came from investors either looking to switch from Bridged BTC (WBTC for example) on other blockchains to Bitcoin L2’s, or from investors looking for more attractive opportunities than Ethereum or Solana-based coins as the incentive campaigns of bitcoin projects often yield attractive current returns and asymmetric upside.

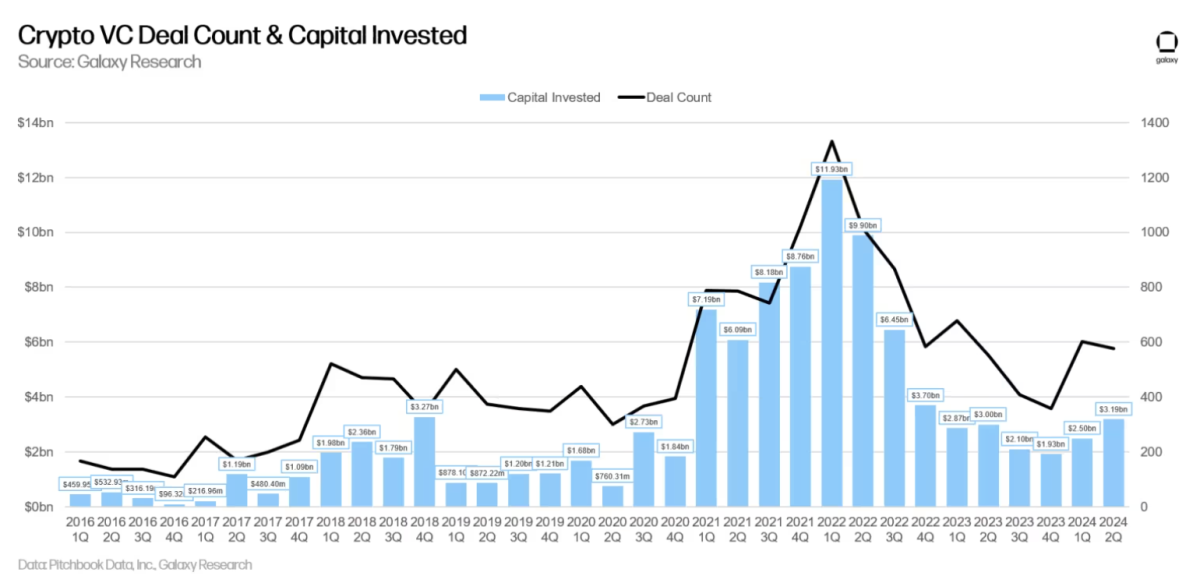

2. Venture Capital knowledge about Bitcoin remains limited. As it was highlighted in the most recent Galaxy report on Blockchain Venture Capital, the appetite for crypto investment has steadily increased YTD but remains nowhere near the top of Q1 2022. From the report: “In Q2 2024, venture capitalists invested $3.194bn (+28% QoQ) into crypto and blockchain-focused companies across 577 deals (-4% QoQ).”

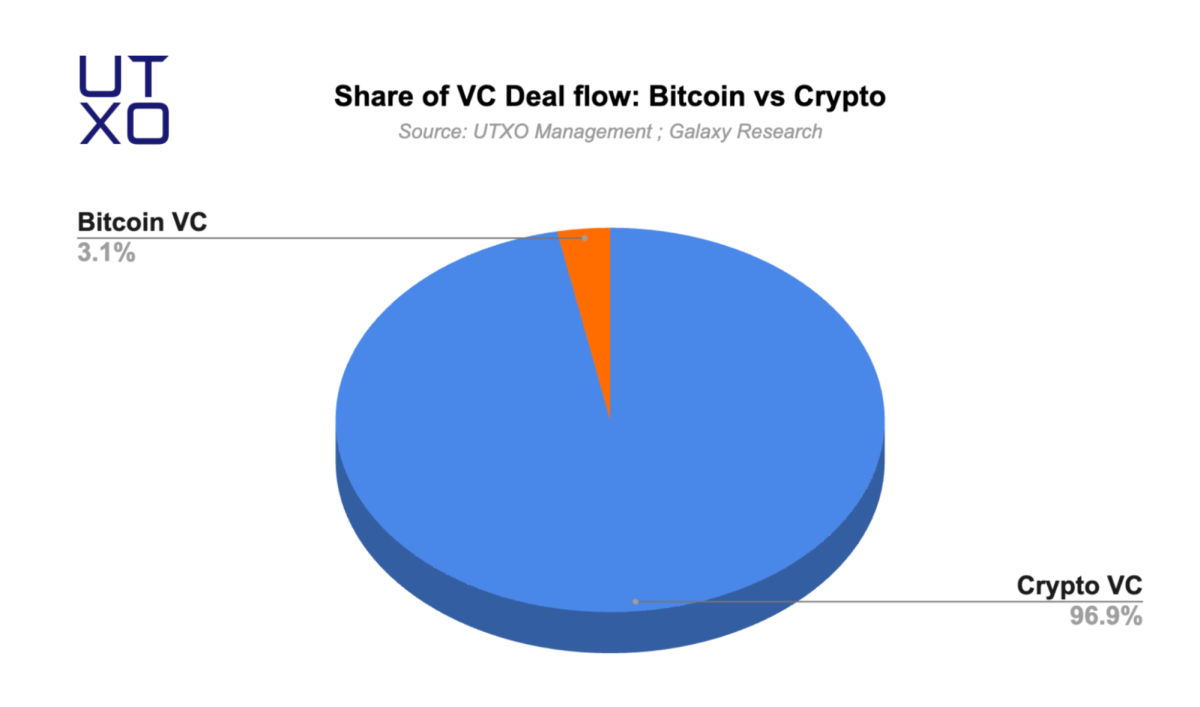

While this is a good sign for the space, Bitcoin investments only represented 3.1% of total deal flow or $96.4M in Q2 2024 while Bitcoin market capitalization constitutes above 55% of the whole crypto market.

We believe that this trend will quickly reverse as the nature of the asymmetric opportunity that Bitcoin Defi / Infrastructure represents becomes impossible to overlook. One possible explanation for the current lag in Bitcoin VC funding is that technical knowledge of Bitcoin mechanics is not as equally distributed among VCs as it is for the rest of crypto. Bitcoin analysts are few in number and the Bitcoin space has been historically closed to VCs as the lack of programmability of Bitcoin hindered its attractiveness. We also expect this to change soon as the incentive to understand the ins and outs of Bitcoin in a less crowded market will bring additional technical talent (developers included).

3. We’ve got the Alpha. Henry Elder from UTXO highlighted during Alpha Day all the ways that traditional investors should think about deploying on-chain Bitcoin capital. Some takeaways:

BTCfi is in its infancy and can be broadly organized into 3 categories: sidechains, Layer-2 chains and metaprotocols.

- Sidechains are currently much simpler to launch than true Layer 2s, so it’s no surprise that the sidechain landscape is the most developed and mature BTCfi ecosystem, as the products and tools have already been developed over the past several years on Ethereum. These ecosystems also benefit from the highly developed security auditing infrastructure that already exists for Ethereum and its associated L2s.

- Layer 2s: Other than Lightning Network, these products are largely still in the development stage and each implement unique and novel technical solutions to link security to Bitcoin.

- Bitcoin metaprotocols that use the bitcoin chain directly and are the most bitcoin-native classification. They use bitcoin-native assets and the relevant details of their operations are encoded directly into bitcoin blocks, although they must be decoded using custom indexers. Arch Network is an example of a metaprotocol that supports BTCfi applications, but Ordinals, BRC-20s, and Runes are also metaprotocols, they simply support BTCfi assets.

The only real Layer 1 option to build on in the past has been Ethereum and a few other blockchains. Bitcoin now offers an alternative that is economically more secure, credibly neutral, and potentially offers superior technological security, as well, by dint of a lower attack surface than Ethereum. Legacy projects can remove billions of dollars of annual expenses and/or inflation by moving to a proof-of-stake model using BTC or an L2 directly on top of Bitcoin, while getting better security and maintaining a high degree of technological and cultural independence.

Bitcoin L2’s – The cool kids on the block?

1. L2’s were the center of attention. With no surprise, L2’s were the talk of the town in Nashville. BitcoinOS (Grail) announced their new rollup protocol by verifying a proof directly on Bitcoin (BitVMX had done something similar just a few days earlier on testnet). Bitlayer and many others were big sponsors of the conference, often hosting some of the coolest afterparties throughout the week. All of this to say, the momentum was definitely in favor of L2s (mostly sidechains as Janusz from Bitcoin Layers would be wise to insist upon). I expect this trend to grow as these projects look to onboard more projects to their platforms in the hope of building a community moat sufficiently strong to withstand the extreme level of competition in the space. However, at 80+ and counting, it became apparent that the hype would be short lived for many. People are mostly aware of the main players in Asia and the US, but the others will remain behind the fog of war unless they bring new innovations to the table. An important moment during the conference was also Cathie Wood on the main stage talking about Bitcoin L2s with Alyse Killeen. This could be a signal that larger institutional players are thinking about coming into the space (Franklin Templeton DA also held a private event with several VC firms, including UTXO).

2. Rollup teams are at the forefront of Bitcoin research. Something that became very clear to us after meeting the teams at Alpen, Bitlayer, and Citrea is the level of technical research underway in the Bitcoin space. The paradigm shift from BitVM has catapulted some of the brightest minds in the space toward exploring the frontiers of Bitcoin script and Zero-Knowledge Proofs. The work being accomplished now will likely onboard the next million users to Bitcoin, with trust assumptions that could satisfy a majority of users.

The main takeaway from those discussions was that, although the excitement around rollups is warranted, many challenges persist. In first place, the cost of posting Data Availability to Bitcoin. While this is bullish for miners, the race is on to provide the most optimal solution while preserving the ability for users to trust the least amount of intermediaries in the process (trust-minimized solutions). Another takeaway is that those teams are preparing to release new technical documents to the public, bringing new understanding of how they are planning to design bridges for these rollups.

3. Lightning aux oubliettes (An oubliette – from the French oublier, meaning ‘to forget’ – is a basement room which is accessible only from a hatch or hole in a high ceiling). Apologies for the clickbait title, but for all intent and purposes, Lightning was effectively memory-holed from everyone during the conference as people focused all their attention on Trump and new shinier objects (sidechains). Alex B from Bitcoin Magazine raised the issue as he was speaking during Alpha Day “I don’t think I’ve heard one person mention Lightning yet”.

Forgotten maybe for a few days, but certainly not dead. Once fees spike again (this is not an if but a when) I’m certain that Lightning will be at the center of every discussion again (“Can I get some of that inbound liquidity bro”).

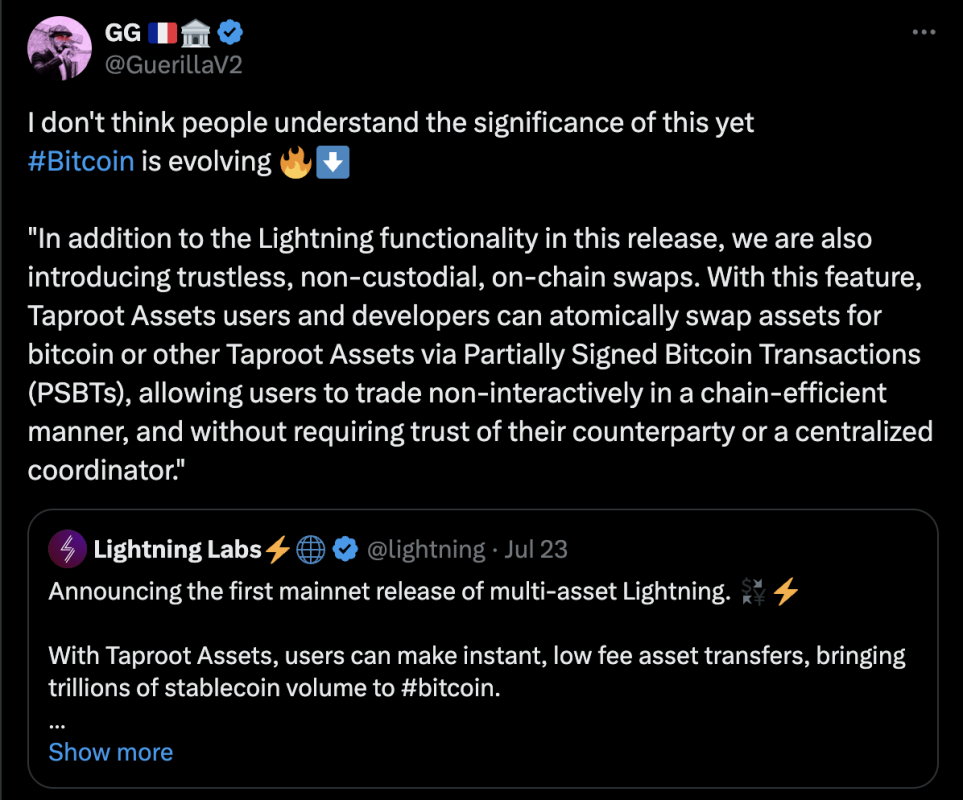

In any case, the Lightning space continues to grow and improve, slow and steady style. Just before the conference, Lightning Labs announced (finally) the release of Taproot Assets on Lightning. My reaction to the announcement:

Lightning-fast, trustless swaps, natively on Bitcoin (producing Yield for nodes). People always say that being too early is the same as being wrong, but in the case of Lightning I believe this is the best possible outcome for capital allocators. Sure Lightning does not have the degens, it does not have the culture, but it does have the superior token standard and network effect. Many of the people I talked to at the conference tend to oppose Runes/BRC-20s to Taproot Assets, I think they are complementary. Precisely because one has the community, and the other has the means to offer that community huge cost savings and faster transaction settlement (in a completely trustless way).

Therefore, the major takeaway for me was that investing at the intersection of Runes/Bitcoin native assets and Lightning infrastructure will become very powerful as demand will naturally flow toward these projects (Joltz and LnFi are great examples that come to mind).

Mining – Is it even mining anymore?

1. Hashprice is no longer the key to becoming a profitable miner – it’s “we’re building an AI pilot project”. It has become apparent throughout my discussions with miners and analysts alike that the only catalyst propping up miners currently has nothing to do with mining and everything to do with capital allocation. Miners are choosing to allocate resources to AI and HPC, while investors are choosing to allocate resources to miners with the most exposure to these relatively new verticals. There are a few reasons for this shift:

Post halving, miners are struggling to maintain attractive margins as transaction fees generated from Ordinals and Runes have been (so far) disappointing. This has led many to consider alternative sources of revenue, preferably something high-margin, predictable in time, and compatible with existing infrastructure. AI is the perfect fit.

Markets are also generously rewarding miners with AI exposure as the marginal effect of hashrate procuration announcements forced miners and analysts to rethink how publicly listed companies should be valued.

While this trend, in large part attributable to Core Scientific and Iris, may appear to be waning in favor of a return to sanity, many present at the conference are betting on selling their available capacity at a premium to AI/HPC companies.

Nonetheless, other catalysts for mining growth became apparent last week, including the somewhat unexpected progress in ASIC design efficiency (Bitdeer in particular targeting 5J/TH in 2025) and the return of institutional financing for miners led by Cantor Fitzgerald announcing a $2 Billion financing business expected to grow well beyond that. This is important because, unlike during the 2021 mining cycle where miners mostly relied on ASIC-backed loans to raise capital, capital markets have been closed to miners since then, forcing them to rely on highly dilutive ATM offerings. This announcement could be the turning point for miner financing during the 2025 cycle.

2. The Commoditization of Blockspace is becoming a reality. I had the chance to attend the launch party of Alkymia, hosted by Blockspace Media. For those not familiar with Alkymia, their newly released platform allows you to take a directional bet on Bitcoin transaction fees. This is the latest addition to a suite of tools allowing miners to stabilize their revenues while allowing exchanges, protocols, and traders to hedge transaction fee volatility risks. As blockspace becomes more valuable, the complexity of transacting on-chain will grow, giving an edge to specialized actors understanding the nuances of Bitcoin’s mempool.

Mempools were also a big topic of discussion last week as the additional programmability of Bitcoin and the introduction of Rollups could introduce some forms of MEV or MEVil to the protocol (more about this below). Understanding the potential of MEV on Bitcoin was a big concern and our investment in Rebar Labs has never made more sense. While we are still early in those discussions, general consensus among the people I talked to was that MEV on Bitcoin will be different from ETH, with less centralization risks and more accessible opportunities for all miners.

3. The spirit of Matt Corallo’s speech was overlooked. Being scheduled to speak right before the future president of the United States is never an easy exercise. However, Matt laid out the most fundamental principles that make Bitcoin what it is today in a brilliant way that would deserve more attention.

In particular, his framing of the blocksize wars – in front of many thousands of listeners – was spot on. This period of Bitcoin’s history was not so much about the size of blocks as it was about the process of governance – who decides the when and what of change to the code?

The beginning of an answer was found immediately after 2017 – miners and corporations do not. The post-conference euphoria that followed BTC++ earlier this year can also serve as an exemplary answer – developers/technical commentators do not. The only stakeholders left in the Bitcoin triumvirate of governance are users, and while users ultimately have to cooperate with miners and developers to cement of change of code into the blockchain, they remain the gatekeepers of unwanted change to the protocol. Bitcoin is not the code, it’s not the blockchain, it’s not even the currency – Bitcoin is a consensus among users.

So, after more than 22,000 people showed up in Nashville to learn more about Bitcoin, what did we learn from them?

Talking with some Nashville natives and international visitors, here’s what I could gather:

- Change is exciting and most people have a favorable view of recent proposals supposed to bring additional functionality to Bitcoin. Most don’t understand what they could change or how they work. Educational content that is accessible to everyone is sorely lacking.

- UX is the number one concern that always comes up in some sort of fashion. I’m mainly deriving this from trying to orange-pill Uber drivers (I think they may hate us now!) and restaurant/bar staff. Most people know Bitcoin, have heard of it, and have bought some before. The most common thing was people holding it on mobile-focused platforms like Cash App and did not understand how to request a deposit to their address (Lava has a great wallet making Bitcoin more accessible to users). Above everything else, I think the next upgrade to Bitcoin should make it easier for people to self-custody their bitcoin – which is coincidentally what is needed for them to later interact with L2s and apps. I do believe that focusing on infrastructure investment will be paramount this cycle.

I hope you like this recap. If you are a Bitcoin Builder or an investor interested in learning more about what we do at UTXO, please reach out to us on X or directly on our website.

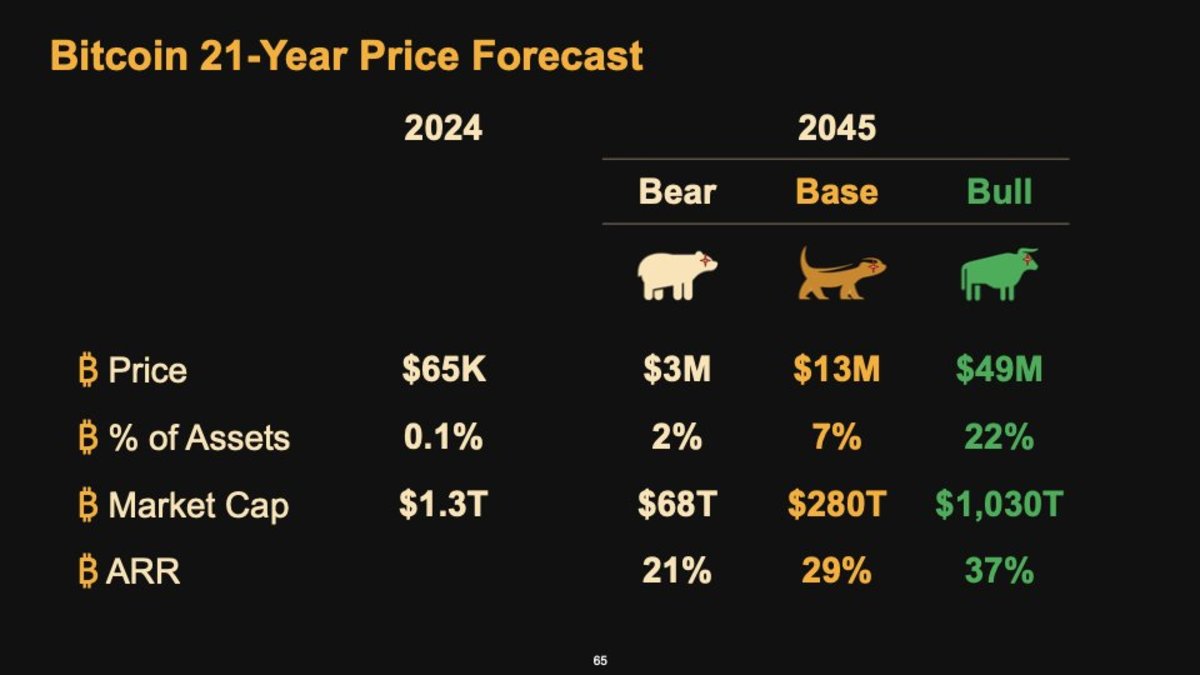

To end on a positive note, let’s not forget to highlight some of the hopium math presented by Michael Saylor during the conference, predicting a BTC price of $13M by 2045. You’re daily reminder that you’re probably not bullish enough.