The Bitcoin-Backed Dollar in Dialogue

In July a bitcoin-related topic was broached by Robert Kennedy Jr., which to my knowledge has not been addressed by anyone holding the top office of the executive branch or a notable candidate for the position of President. Of course, John Nash’s Ideal Money is a perennial topic, one I have explored conversationally in the past. It can be a controversial and divisive position, just like other opinions RFK Jr. holds, with a few proponents endorsing even more radical thoughts than the common consensus. How meta…

But to contextualize the totality of what RFK Jr. said regarding a Bitcoin-backed dollar requires us to do a little homework. Luckily, Bitcoin Magazine’s Editor-in-Chief Mark Goodwin has done a lot of the informational legwork for us in a piece he published in 2021.

“I had understood the concept of the Nash equilibrium in regards to Bitcoin for a while, but it wasn’t until 2021 that I got really into his work and decided to read all his papers. Ideal Money was introduced to me by a couple of gentlemen on Twitter who had been writing about Nash and Bitcoin for years, Jal Torrey and Jon Gulson. I know the ultimate monetary showdown is between the U.S. dollar and Bitcoin, and the Ideal Money concept really outlines an articulate path forward for monetary policy and inflation targeting as political and apolitical money collide. Money is just a technological tool for bargaining, and no one understands the axioms of bargaining better than John Nash. I recommend reading The Essential John Nash by Kuhn and Nasar, Parallel Control, as well as the various iterations of his Ideal Money lectures to begin to grok the Nashian Orientation.”

Mark Goodwin – Editor-in-Chief of Bitcoin Magazine

In the past, we covered the concepts of inflation, Nash’s Equilibrium, and Breton-Woods with enough depth to point to these conversations as milestones along the path to giving Ideal Money the attention it deserves.

So why is this concept important now?

Motion images created via Pika Labs

The Asymptotic Approach to a Beautiful Mind

Well, there are plenty of cultural and social angles but I think an important one regarding productivity and value erosion is the international uncoupling of gold and the US dollar that occurred during the Nixon administration.

While not all of the zealots advocating for the ideas in John Nash’s final white paper agree on how to interpret everything in the eight total pages, it is a short read and you are welcome to make your own conclusions about it.

One constellation that is critical to grasp is how a “basket of goods”, referred to by the International Monetary Fund (IMF) as “special drawing rights” (SDR), is fairly congruent to Nash’s Industrial Consumer Price Index (ICPI). Let’s keep this simple: imagine a scale. On the left side is an amount of fiat currency of your choice, on the right, is a collection of goods, assets, or commodities (I use these terms very loosely) in all the various combinations you can imagine that would be equivalent to the dollars on the first side at a given rate that is publicly recognized. The right side could even be a collection of currencies. There are those that believe Bitcoin is enough in itself, operating as both the fulcrum and the right side of the scale. This implies an understanding of token mining and, by extension, the value of energy – I am unqualified to expound on this in a way that I believe is satisfactory so I will leave that topic to those more experienced and more knowledgeable about the idea.

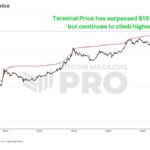

“The ICPI concept was used by Nash to illuminate a vector of quality for money we can dub ‘Idealness’. The asymptotically ‘ideal’ nature of Bitcoin derives from the apolitical and invariant nature of the cost to produce a valid block. Bitcoin is asymptotically (rather than perfectly) ideal because it (self-)adjusts the cost to produce blocks (aka difficulty) to the previous period’s mining computational expenditure and it is invariant in that the adjustment is pre-defined (constitutionally) at Genesis and locked in as such by the ever-increasing entropy of the totality of each of the network participant’s utility functions.

Any major currency that (constitutionally) pegs to Bitcoin thus necessarily inherits the benefits of this quality of idealness.”

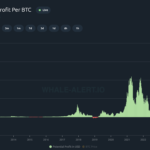

Over the last three and a half years we have watched as central banks have flooded the markets with currency. The cost of goods has increased in the wake of trade route bottlenecks and the excess liquidity available to outbid the competition. We are still seeing commodity price spikes occurring globally, such as in the European energy markets.

Now imagine, if you will, that the scale embodies the concept of Ideal Money. This tool offers a more complete view of the price inflation occurring on the fiat currency side of things because it can be possessed as an asset itself in an effort to pursue a more conservative monetary policy, riding out the surprise shocks that occur when people pile into an attractive market (the things they really want on the right side of the scale).

And that’s why the US needs bitcoin in its treasury, though it does not explicitly need to back the dollar with bitcoin – whatever that might mean. This creates a situation similar to how corporations can hold Bitcoin on their books while issuing common stock to trade and raise capital from the market.

Attracting Economic Opposites

Economic satirists might seem to be endorsing Modern Monetary Theory (MMT) but their positions lack conviction, we see grand announcements of leaving behind triple-ledger accounting only to flirt with the concept most devotedly. Or worse, embittered positions that seemingly reflect the chanters missed opportunities. Disingenuous at the least, it’s probably an integrity issue.

It’s important to note that these ideas aren’t particularly “modern” in the 21st century, they have been championed by Keynesians since the early 1900s. While the macroeconomic ideas are attributed to John Maynard Keynes, it is worth adding that Nash felt Keynes’ intent was more grounded than the bastardized forms they have taken under the wings of the advocates that affiliated their efforts to Keynes’ original framework.

Elasticity, the capacity for expansion and contraction of the money supply, accommodates opportunity when it arises, to provide a platform for credit and creativity as well as to reign things in when the velocity of a currency is becoming overheated. It’s important to realize that liquidity is what lights up a market’s opportunity. Sure, social capital can potentially do that, however, that doesn’t always translate into the urgency required to execute against the conditions within the timeframe needed for meaningful gains to be produced.

That’s why it is excellent that RFK Jr. has put Bitcoin into the public economic discussion, though the implementation he is recommending lacks the nuanced understanding of how it operates as a balancing mechanism for the equation.

Of course, there is room for everyone’s ideas to be tested in the market. If you like efficiently sized blockspace, or would prefer a more cashlike experience, or want to store data on-chain – the various forks of Bitcoin offer dedicated functionality for the use cases listed here. Still don’t see one that meets your requirements? Fork it! Put it out there and see if it gains traction with users and miners.

This is where the waters get murky…

Any particular chain could be the right one for a time and a location, circumstances determine that. I’m not convinced that we know right now how all of these experiments will play out, it’s only been fourteen years since blockchains were introduced. We wouldn’t give it a driver’s license yet. However, his ideas about how blockchain creates transparency are spot on.

“The opportunity is the prospect of [bitcoin] being used as a medium of exchange. RFK Jr. wants to reduce capital gains tax for bitcoin, which would be good but we should get rid of the capital gains tax entirely. Bitcoin eliminates the need for a central bank digital currency (CBDC) [and] ensures that everyone is accountable, including governments. Forking could be good but there is no provision to handle that legally. Right now if there is a chain split, you have to treat [the new coins] as income.”

Daniel Krawisz – Bitcoiner

To me, forking enables customization. As open as the Bitcoin network is, our internet networks are not. In addition to the discussion of security is jurisdiction. Creating dedicated subnetworks of Bitcoin has already occurred for functionality and I believe that we will see more that are akin to fashion (such as we see in the cryptocurrency industry at large) as well as legal boundaries in accordance with governments.

Dedicating Blockspace to the UTXO-Dollar

So, how does Robert Kennedy Jr. know this is the direction we should go regarding US monetary policy? Sure, there is a latent interest in returning to metal-backed currency and some would conflate this idea with what he is saying in regards to a bitcoin-backed dollar. However, they should not. As the asymptotic model implies, it is a pursuit – a platform to expose low-integrity economic policies and to increasingly reduce the space it has to grasp additional mindshare.

The short of it is: he doesn’t. The position is flawed from the outset but that is all right. In totality, the Bitcoin experiment is flexible, and while fifteen years in, the concept has established itself, that doesn’t mean every application has been explored through each potential iteration. Users must continue to test its viability and we are the government. There is room to run, to see how much territory exists beyond the map, whether that be through forks or merely holding Bitcoin on balance sheets. Inevitably, our politicians will have to grapple with these issues and if Nash has anything to say about it, we will shift toward equilibrium.

For more on John F. Nash Jr.

Mark Goodwin’s “The Birth of The Bitcoin-Dollar”

This is a guest post by Michael Finney. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.