This article is written in partnership with Unchained, the official US Collaborative Custody Partner of Bitcoin Magazine and integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Bitcoin tumbled below $60,000 over the weekend, fueled by conflict between Iran and Israel, sparking fears that escalation could lead to Western involvement in a war in the Middle East—an all too common occurrence in the 21st century that would lead to increased inflationary pressures and disrupt global supply chains and commodity markets. While skeptics were quick to mock bitcoin’s near instantaneous selloff in reaction to the news of conflict, ironically bitcoin was one of the only global asset open for trading on the weekend, with equities, commodities, and bond strategists alike turning their eyes to the bitcoin chart in an attempt to assess what the damage might be to global markets upon the Sunday night trading open.

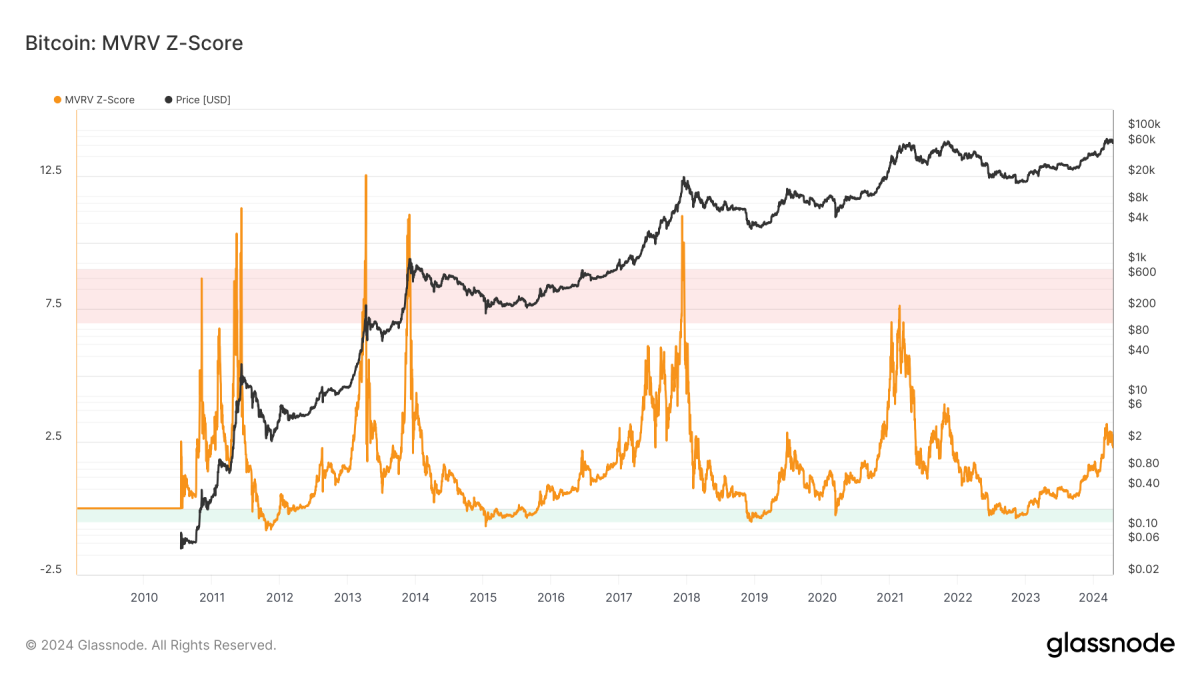

Turning away from geopolitics, this brief article will take a look at the latest in on-chain spending behavior and Bitcoin derivative markets, to analyze whether the current dip from the highs of $73,000 is typical of a standard bull market correction or more so a cyclical peak.

Many preconceived notions of a typical Bitcoin cycle have already been shattered with new highs being broken before the upcoming halving taking place on block 840,000. So let’s evaluate and take a look at where we are, and how these conditions and investor behavior also inform what might come next.

We’ll be looking at both on-chain data, to analyze the actions of incumbent Bitcoin hodlers and new market entrants alike, before taking a look at the derivatives market to gauge whether there is anything worrisome in regards to the leverage currently present in the market.

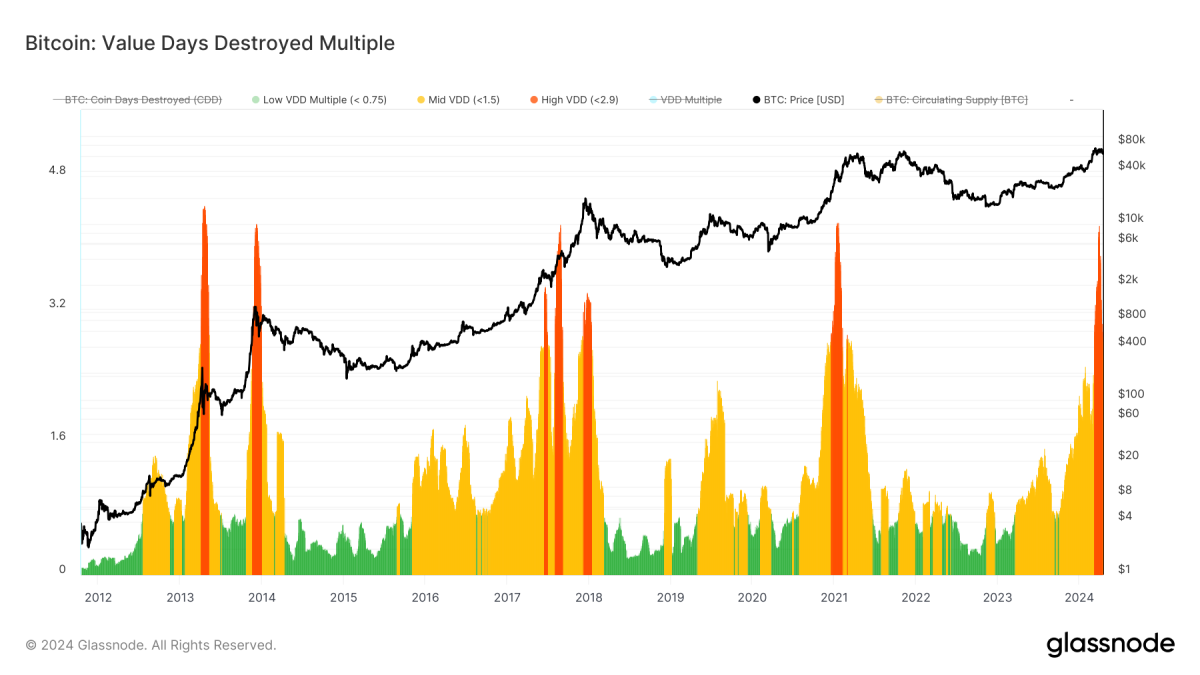

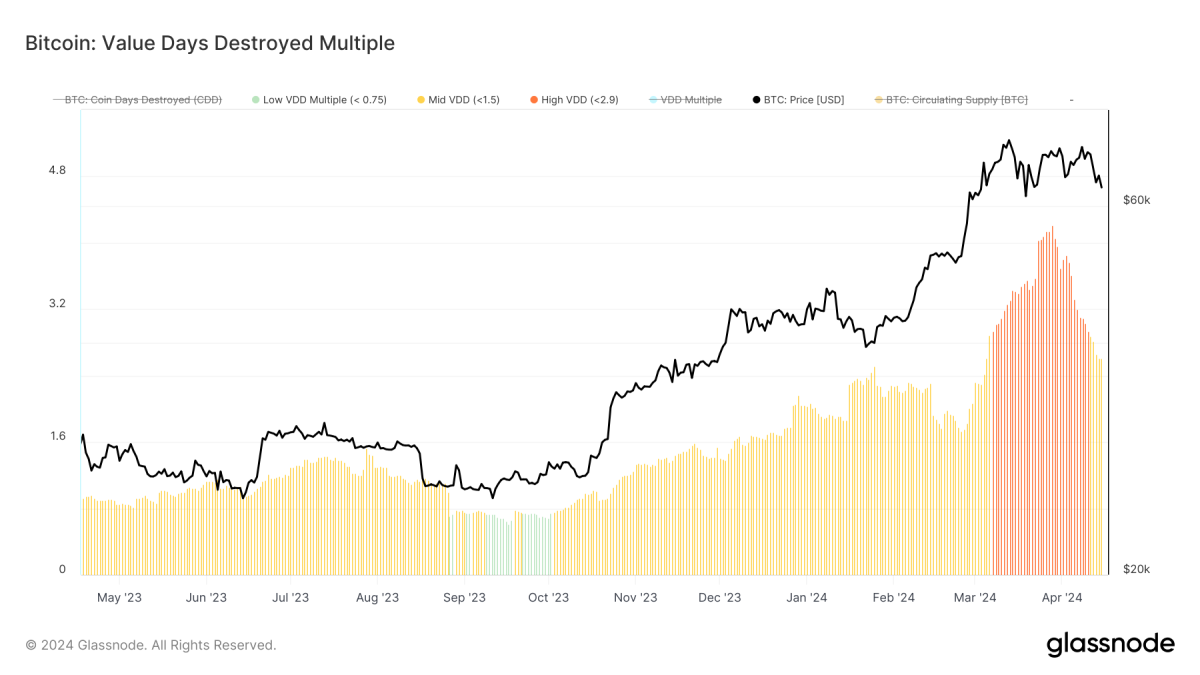

First, we’ll take a look at a metric called the Value Days Destroyed Multiple, coined and created by TXMC, which compares near-term spending behavior to the yearly average, as a means of detecting overheated and undervalued markets. A brief look at this signals that the bull market is well underway, and may have even peaked.

We can attribute approximately one third of the spending as a simple transfer of coins from the Grayscale Bitcoin Trust to new ETF participants like BlackRock, Fidelity, and Bitwise. However, the raw data is just that—the raw data, and we can see there has been a significant amount of spending that’s occurred with the push to new highs.

A closer look at the metric, however, shows that this spending activity is cooling off, and there is historical precedent for new highs in the market in both the 2017 and 2021 cycle – this is merely a data point to keep in mind.

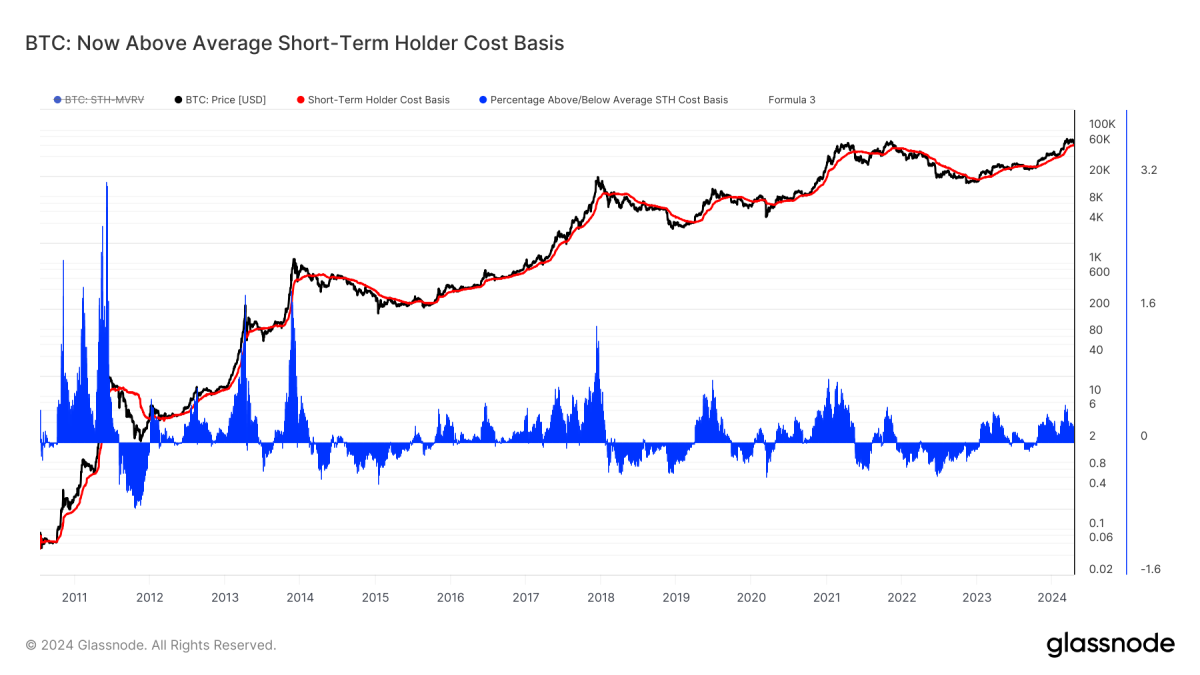

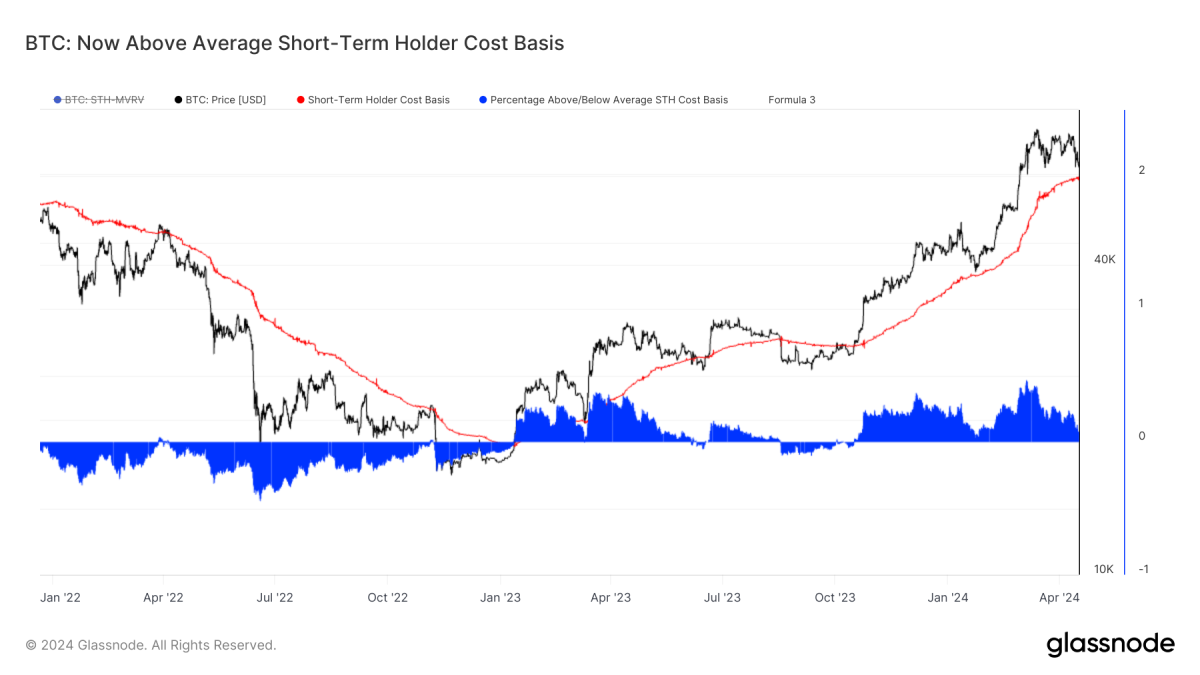

Next, taking a look at the interplay between HODLers and new entrants, viewed through the lens of short-term and long-term holders, we can see that during a typical bull market, revisits to the cost basis of short-term holders are not only typical but also quite healthy.

Additionally, the ability for this approximate price level to serve as support is a characteristic of bull markets, with the inverse being true in a bear market, where this psychological level of average short-term holder price (cost basis) often serves as ironclad psychological and technical resistance. As for where that level is today, approximately $58,500, which means that by no means is a visit to this level a guarantee or certainty, but rather it is something that is perfectly in the norm of expected activity in a bull market.

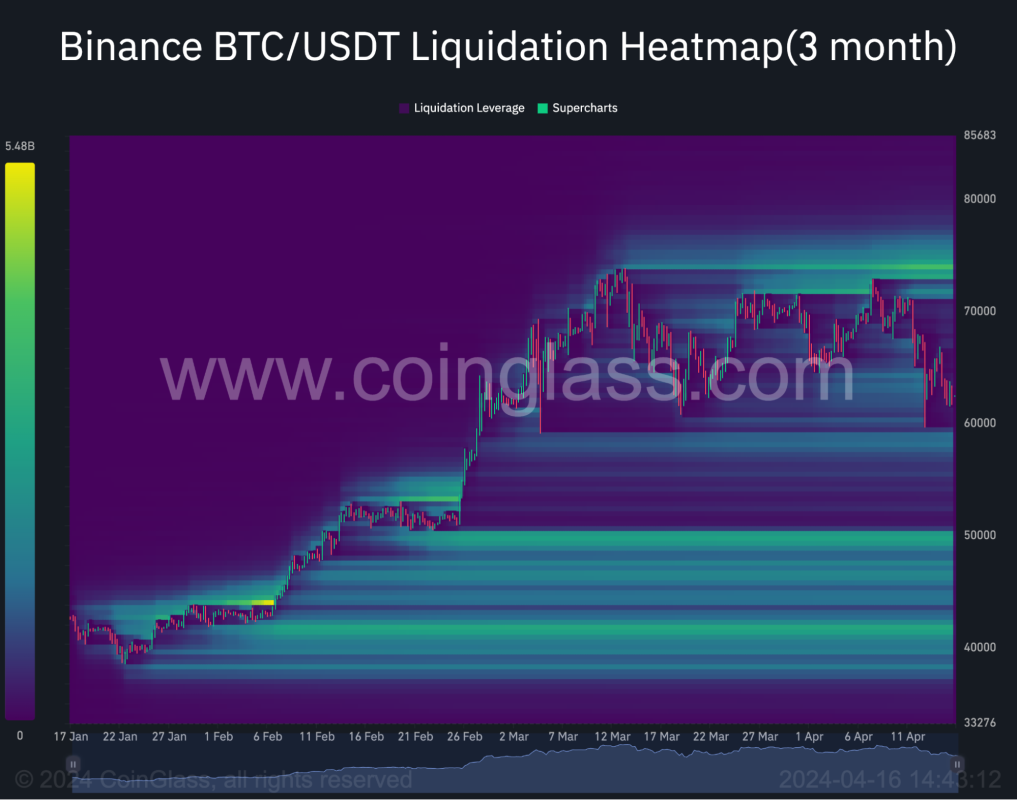

Turning our attention to the derivatives market, there has been a healthy flush of leverage and speculative froth across the market. Perpetual futures open in bitcoin terms are near the lowest levels seen since 2022, while futures have been trading at a slight discount to spot markets since the weekend flush lower. While there is no law or guarantee that this brings about higher prices immediately, similar positioning in the past has fostered the conditions for price appreciation, and when compared to the top-heavy speculative froth of a speculative premium in futures market pricing observed over the last month or so, it is a welcomed development.

In terms of points of interest when eyeing the derivatives landscape, the buildup of liquidatable leverage above $70,000 continues to grow, with emboldened shorts looking to push price meaningfully below $60,000. While there is some leverage to be purged under the $60,000 level, the real prize for bears is under the $50,000 level.

While certainly crazier things have happened in Bitcoin than a -33% pullback from all-time highs, spot demand is likely to be strong from $50,000, and a wipe of open interest and the start of a negative futures premium relative to spot markets hint at most of the pullback having already taken place. It would likely take a significant risk-off moment across the macro landscape for this to unfold, and any dip is likely to be fleeting given the perpetuating reality of the pace of fiscal deficit spending.

Conclusion: This bull market has legs, and the current pullback from the highs, along with any future dips in the exchange rate, should be a welcomed development for investors with a sufficiently long time horizon who understand where this is all headed. Bitcoin’s fundamentals continue to improve, and pullbacks serve to purge leverage and weak handed speculators during secular bull markets.

BTFD.

This article is written in partnership with Unchained, the official US Collaboartive Custody Partner of Bitcoin Magazine and integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.