Today, the State of Wisconsin Investment Board (SWIB) has revealed its substantial investments in Bitcoin Exchange-Traded Funds (ETFs) through a recent filing with the Securities and Exchange Commission (SEC). According to the filing, SWIB holds nearly $100 million worth of BlackRock’s spot Bitcoin ETF (IBIT).

JUST IN: 🇺🇸 State of Wisconsin Investment Board discloses it holds almost $100 million of BlackRock’s spot #Bitcoin ETF. pic.twitter.com/Jdv4uKSi9J

— Bitcoin Magazine (@BitcoinMagazine) May 14, 2024

This disclosure marks SWIB as the first state-level institution to publicly announce its holdings in spot Bitcoin ETFs, signaling a notable step in the integration of Bitcoin into traditional investment portfolios.

“Wow, a state pension bought $IBIT in first quarter. Normally you don’t get these big fish institutions in the 13Fs for a year or so (when the ETF gets more liquidity) but as we’ve seen these are no ordinary launches,” Bloomberg Senior ETF Analyst Eric Balchunas commented on the news. “Good sign, expect more, as institutions tend to move in herds.”

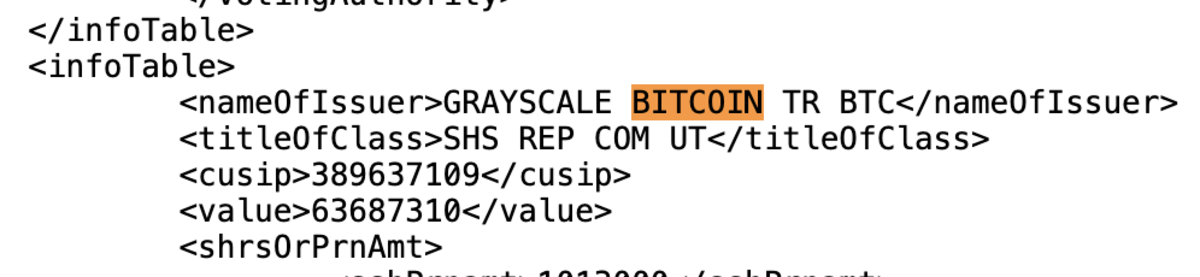

SWIB also disclosed in the filing that it holds over $63 million of Grayscale’s spot Bitcoin ETF (GBTC), totaling over $162 million between these two holdings.

The recent wave of 13F filings by institutions disclosing their Bitcoin ETF holdings highlights the increasing institutional interest in Bitcoin. These filings not only include prominent institutional investors like SWIB but also major traditional firms such as the largest bank in America, JPMorgan Chase, which has disclosed its spot Bitcoin ETF holdings as it serves as a market maker for these ETFs.

“This is a small part of a massive public investment fund (total value of all positions in the 13F filing is $37.8 billion). But the long-term importance cannot be overstated,” stated market researcher and analyst, MacroScope. “Wisconsin is now the second-largest reporting holder of IBIT globally. This will be closely analyzed and widely discussed by other state investment boards. Watch for others to follow in coming quarters.”