The rehabilitation trustee for the now-defunct Mt. Gox exchange moved over $6 billion worth of bitcoin on Tuesday morning as it took further steps toward reimbursing creditors.

JUST IN: Mt. Gox moved 95,870 #Bitcoin worth $6 billion to unknown addresses 👀 pic.twitter.com/duCIiVPcsK

— Bitcoin Magazine (@BitcoinMagazine) July 16, 2024

On-chain data shows that Mt. Gox’s wallet transferred around 95,870 BTC across two transactions to newly-created addresses. The first shift of 47,000 bitcoin was valued at nearly $3 billion.

The destination wallets remain unidentified but are presumed to be linked to Mt. Gox’s ongoing repayment process. The exchange owes creditors $9 billion in total, stemming from Bitcoin lost in Mt. Gox’s infamous 2014 hack.

Saturday’s large transactions follow initial smaller test transfers last week as Mt. Gox prepared to distribute funds. Analysts have feared the payouts could weigh on Bitcoin’s price if creditors immediately liquidate holdings.

So far, the transfers have coincided with dips below $64,000 as markets reacted cautiously. But the expectation remains that most creditors will hold the restored coins rather than rush to sell.

While unnerving for traders, the long-awaited Mt. Gox reimbursement will close the book on one of the Bitcoin industry’s most infamous episodes. Tens of thousands of early adopters lost holdings when the pioneering exchange collapsed.

Over eight years later, creditors will finally recoup some of those early losses. The saga underscores Bitcoin’s resilience and the community’s commitment to accountable custody and transparent transactions.

UPDATE:

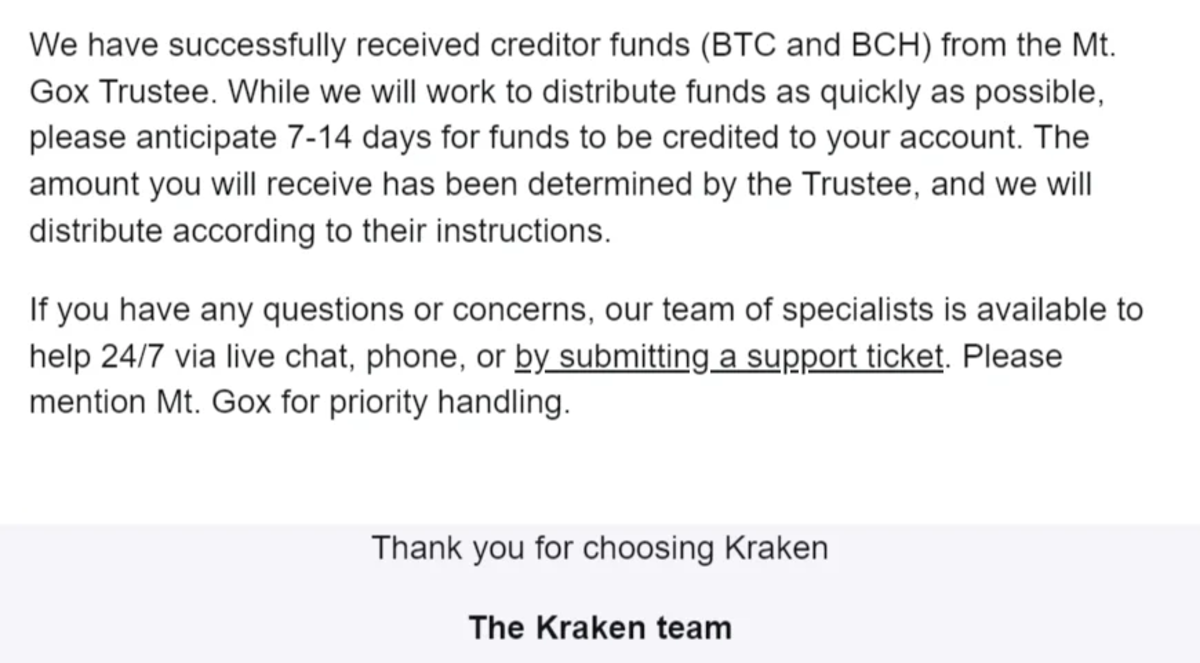

Bitcoin and crypto exchange Kraken confirmed that it received Mt. Gox creditors’ funds, according to the emails sent to Mt. Gox creditors. “We have successfully received creditor funds (BTC and BCH) from the Mt. Gox Trustee,” Kraken wrote in the email.

“While we will work to distribute funds as quickly as possible, please anticipate 7-14 days for funds to be credited to your account. The amount you will receive has been determined by the Trustee, and we will distribute it according to their instructions.” Bitcoin Magazine later confirmed Kraken’s email via a source.