I was asked repeatedly throughout this year’s Bitcoin 2024 conference what my highlight of the moment was — what the signal was amongst the noise. As I returned from Nashville, it occurred to me that, each time, I could never answer the question satisfyingly.

In part, because I simply couldn’t keep up. The activity around the news desk and my support for those running the show left me with little time to focus on anything else. I can’t say I regret it. Anyone who gravitated around our livestream studio space during the week can attest to the energy surrounding it. The Bitcoin Magazine news desk was the veritable heartbeat of the conference.

Now that I’ve had time to collect my thoughts, I can confidently say what stood out most from the conference was the understated presence of the Lightning Network. In different times this would have been a concern but this felt different. It struck me that Lightning has not only arrived but has matured beyond what any other scaling layer can realistically claim.

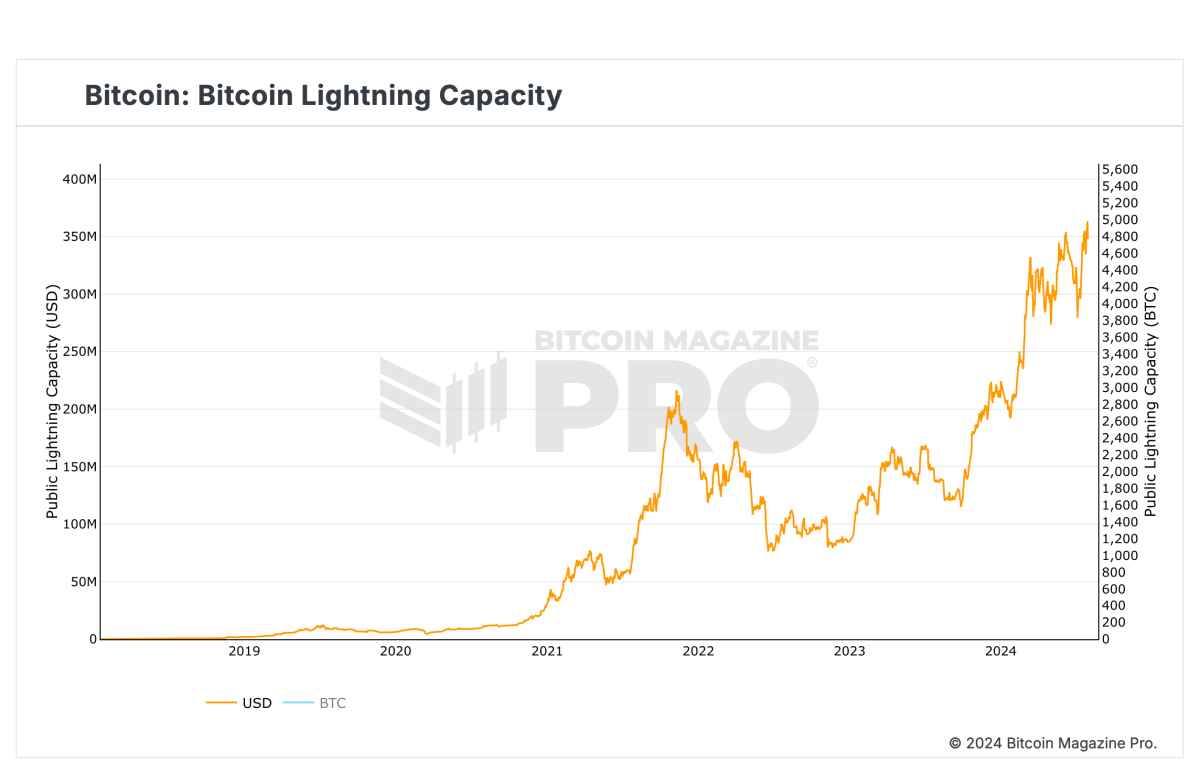

Largely unnoticed, the payment protocol has quietly inserted itself into every piece of major Bitcoin infrastructure. Most of the world’s leading exchanges now support it, with some running the largest nodes on the network. The dollar-denominated capacity of the network is at an all-time high, and every operator I spoke with this week confirmed its rapidly improving reliability.

Though it might have looked to the casual conference goer that Lightning had taken a back seat to other popular up-and-coming protocols, it was clear during the conference how vastly ahead it is from the rest of the field. While I was fortunate to meet many talented individuals working on this new generation of Bitcoin technical design, I left the event with more questions about their progress than when I arrived. Lightning, on the other hand, answered many concerns about its status and the road ahead.

Sights on settlements

A recurring narrative during the event was the protocol’s promises as a settlement network. Initially promoted as a retail payment solution, Lightning’s latest and biggest headways might be among businesses and institutions looking to satisfy liquidity needs. The vision, popularized notably by Jack Mallers at Strike, feels more concrete than ever, with infrastructure company Lightspark now at the forefront of these accomplishments. Last Thursday, on the Nakamoto stage, Lightspark’s co-founder Christian Catalini argued for Lightning’s favorable position as a bridge between companies and various financial institutions:

If you think about the challenge of moving value not just between a few countries but two hundred or more countries, every day, 24/7, with deep liquidity. There is only one asset, and that asset is bitcoin. It has regulatory clarity, it has on and off-ramps in pretty much every country around the globe. Now we can connect it all in an open way.

Lightspark’s recent announcement of its partnership with Latin America’s banking giant Nubank clearly outlines the potential for existing firms to modernize their infrastructure using the Lightning network.

Further strengthening the case of Lightning as a rail to connect the global economy, last week’s release of Lightning Labs’ Taproot Asset protocol introduces yet another opportunity for the scaling layer to establish itself as the dominant value transfer protocol on the internet. Before Lightning can come for VISA, it might have to start by displacing SWIFT.

Improving payments

On the payment front, the talk of the town in Nashville was the improvement in user experience brought about by the arrival of features like BOLT12.

Years in the making, the payment protocol offers an intuitive way for users to receive Lightning payments without relying on unreliable, expiring, invoices. It also paves a promising path toward improving users’ ability to receive payments offline, a major pain point of current implementations.

Introducing #TwelveCash, a simple way to share your bitcoin payment info with the world. pic.twitter.com/tynzAVEEEt

— Stephen DeLorme (@StephenDeLorme) July 18, 2024

BOLT12 achieves this through static, reusable, offers that do not compromise receiver privacy. Combined with other innovations like DNS payment instructions, it is now possible to create human-readable Bitcoin addresses (ex: alex@twelve.cash) that support different payment formats. Imagine using a single identifier to receive on-chain and Lightning payments regardless of your preferred standards. Twelve.cash, a standout project from this year’s conference hackathon, did a remarkable job highlighting the versatility of this technology, implementing “a simple way to share your bitcoin payment info with the world.”

Other forms of human-readable addresses have existed for some time using the LNURL format but the hope is for users to converge to more mature solutions. Long-time Lightning infrastructure provider Amboss also announced during the event a new Lightning wallet supporting a novel, multi-asset, payment system they’ve called “MIBAN”.

Fragmentation between standards and compatibility issues is anticipated in open and permissionless financial systems. Lightning is further than any alternative in terms of optimizing around these interoperability challenges to ensure seamless payment experiences.

BOLT12 is currently supported by leading wallets like Phoenix and ZEUS, and could land on the Strike app soon.

Following Bitcoin Park’s Lightning Summit around the same time last year, I remember feeling pretty disillusioned about the prospects of consumer Lightning apps. What a difference a year makes. While a fully non-custodial experience might always command a premium, new optimizations, and different security models are emerging that can meet retail users where they are.

Infrastructure at scale

This progress, at every level, would not be possible without the momentous efforts that have gone into infrastructure work over the last couple of years.

Lightspark’s recent integration of Coinbase is powered by Spiral’s Lightning Development Kit (LDK). Recently announced Alby Hub is also the first production wallet deployed using the LDK node library.

Keep in mind that LDK has been in the works for almost four years now. Good things take time. Many people I spoke to during the conference expect the scope and quality of projects to be deployed using this toolkit to significantly accelerate.

Another signal of the evolving Lightning infrastructure came from the release during the week of Breez SDK’s new Liquid integration. This is a trend that is picking up pace and has been pioneered by Boltz’s swapping services. Used in wallet applications like Aqua, Liquid empowers developers to use the sidechain network’s cheap fees to settle transactions in and out of Lightning into L-BTC. While this involves custody tradeoffs, proponents argue it remains a superior option to fully custodial Lightning wallets.

Also in topic during the conference was the progress made at the Lightning Service Provider (LSP) specification level. As a result, the quality of service providers on the network has significantly increased. LSPs are used to provide infrastructure support and liquidity provision to companies wanting to connect to the Lightning Network.

Zeus’s founder Evan Kaloudis shared his company’s effort in this direction:

Since the legal uncertainty in the space arose following the arrest of the Samourai Wallet developers, we’ve doubled down and now have two different services that provide users with connectivity to the Lightning Network. We’ve also massively expanded the Olympus LSP userbase; we now are not only powering the ZEUS wallet, but we’ve now got integrations in a total of four different wallets, including a role as the default LSP in Mutiny Wallet.

Security is another area of the protocol seeing impressive growth. Spiral grantee Sean Gillian’s work on Validating Lightning Signer (VLS) will play a significant role in scaling this technology to power users. Allowing operators to leverage secure enclaves to protect hot signing keys and set spending policies will be required to onboard the next wave of institutional players.

In a panel I hosted Saturday afternoon called “Lightning for Institutions”, the protocol’s co-creator Tadge Dryja expressed strong interest in the development of more secure key management processes.

We’ve worked out how you can implement multi-signature support for Lightning nodes. We have done the math, we know it works. Now we have to work with everyone to get there.

It would not be an infrastructure section without mentioning the massive innovation around the Nostr protocol and its implications for Lightning. One of my favorite Pitchday projects at the conference was Flash, a new payment gateway platform that leverages Nostr for seamless integration of Lightning into any internet services or products. The consequences of using the Nostr messaging protocol as a bridge between Bitcoin applications are not yet fully appreciated. The Flash team has an incredible vision for it. Shoutout also to Justin from Shocknet who I met and is exploring many interesting ways to scale the Lightning protocol using Nostr’s magic sauce.

It’s time to stop fading Lightning.